|

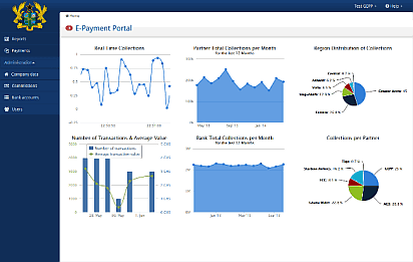

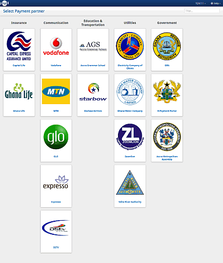

Payall is an innovative and secure electronic payment solution with integrated virtual accounts (E-wallets) that allows public or private sector organizations to manage partners and clients, set up agent networks and monitor revenue and payments in real time. It provides a one-stop-shop, linking businesses with their consumers rather than each organization having to set up their own network. It supports the full range of financial services including bill payments, funds transfers, loans and savings or remittances I FX. Payall integrates with a national switch or licensed partner bank, operates under a financial service partner´s license or national E-money regulation. Deployment options include cloud-hosting or in-country hosting. A settlement engine ensures daily settlement of funds.

|

BACK END & INTERFACES |

|

Stakeholders (collection partners, banks, merchants or agents) are able to monitor payment transactions and bookings in real time. Transactions are typically handed over to the partners´ billing system.

SOLUTION FEATURES

INTERFACE TYPES

|